7 Insanely Practical Money Tips for Anyone Who’s Ready To Improve Their Finances Now

Want to know the best money tips that can be life-changing? These are the most practical ways to save money, pay down debt, that you need to know about.

Money Tips was one the phrases that was mostly googled during April 2020, in the middle of the pandemic. (And it doesn’t have to take a pandemic for you to learn about personal finance, budgeting, and saving.)

I’m giving you the top money tips, I wish I knew early on and now swear by.

Getting your finances under control is extremely exciting! And, if you are anything like me, you are probably doing all the research you can to stretch every single dollar.

Now you are going to learn all about money tips and tricks that are super practical and you can implement right away.

This post is all about money tips you might not have thought of.

Best Money Tips:

1. Money Tips for 2021:

Invest time in yourself by learning all you can about personal finance. Start reading books and blogs on personal finance. Also, go follow Instagram accounts on personal finance. And, go on Youtube and watch videos on how to budget.

I’m sure you are super busy taking care of everyone, but yourself. So, try to take a few minutes every day to soak in all you can about personal finance.

If you are buried in debt, just like me, go to a local used book store and buy Dave Ramsey’s book “The Total Money Makeover.” Not to be dramatic, but this book will be a total game changer for your finances.

However, if you don’t have any money to spend right now, listen to his podcasts that are totally free!

2.More Money Tips for Young Adults:

Get multiple checking accounts. There are plenty of free checking accounts out there. You should have at least 3 different checking accounts to separate your money, so it’ll be easier for you to stick to your budget.

You should have your main checking account, (where you get your direct deposit check from work). After you get paid, you should transfer money to your second checking account, (the account you use to pay your fixed expenses aka your bills.)

Your third checking account should be for your spending money. This would be the only debit card you would be swiping for all your wants.

(Remember, checking account #1 is where your money lands from your jobs, this account should only be used to transfer money out of to the other 2 accounts. You should never have to swipe your debit card with this account, unless you have enough funds. The same goes with the 2nd checking account).

By having 3 separate checking accounts you can create boundaries for your money and guide it to where it needs to go. If you just have one checking account, chances are your money will disappear faster. And, it will be hard to see how much money you actually have to spend (without cutting into your bills.)

Organize your money by having 3 separate checking accounts and transfer money out as soon as you get paid.

3. Simple Money Tips:

I personally would recommend having 3 separate savings account…preferably online high-yield savings accounts. (Not regular savings accounts connected to your bank, which earn like 0.01% in interest.)

For example, Savings #1 account should be dedicated to your emergency fund. After that, Savings Account #2 should be dedicated to your sinking funds, or short term savings goals. Maybe you are saving up for a vacation, or an anniversary gift, or a big yearly expense such as an insurance bill.

In other words, the Savings Account #2 is an account that you know money won’t stay there forever (it’s only for short term savings.) Money will be spent as the bills or events come up. But, having this Savings #2 account in place, allows you to organize your money and have it ready to use, so you are always extra prepared.

This money tip is brilliant, because if you leave this money sitting in your checking account to pay for an expense couple months away, your money will be gone. And once that bill or event comes up, you’ll be scrambling looking to see where you can find money to cover that expense.

Lastly, you should always have a third savings account for long term goals. Maybe you want to save for a car or a house. So, have a dedicated savings account for money goals that will take you longer than 12 months to achieve.

Finally, separating your savings account will allow you to allocate your money into different buckets, so your money doesn’t sit in your checking account and gets spent fast! For once, you’ll be in control of your money and prioritize your money goals faster.

4. Create a Budget:

When you hear the word “budget,” you might want to cringe. You probably think that creating a budget is the hardest thing in the world.

And, you probably feel that a budget will restrict you from enjoying life. But the truth is that a budget gives you freedom, since it is just a spending plan. That means YOU are in control of it, which is actually pretty dang exciting!

So, create a budget that reflects your life and one that will help you achieve your money goals. And, it doesn’t have to be hard at all. Here’s exactly a step-by-step guide on how to set up a budget.

5. Money Tips and Tricks

This insanely popular tip is a must! Pay yourself first.

When your budget is tight, you need to set REWARD yourself first, so you won’t burn out. So, set aside 10% or 20% of your paycheck BEFORE you start paying all your bills.

For instance, you can start out by at least paying yourself 10% of out of every single paycheck. Then, transfer that money into a savings account. As your budget gets more established, you can bump up that amount to 15% or even 20%.

To illustrate, if you get paid $1,000, you WILL pay yourself first 10% (which is $100) every paycheck. Then, you will transfer that $100 into one of the savings account mentioned above.

Remember, you can always access that money if you need to. For example, if you saved $100 but needed to use $25 on take-out, then you at least saved $75 out of that paycheck.

Got it? Good!

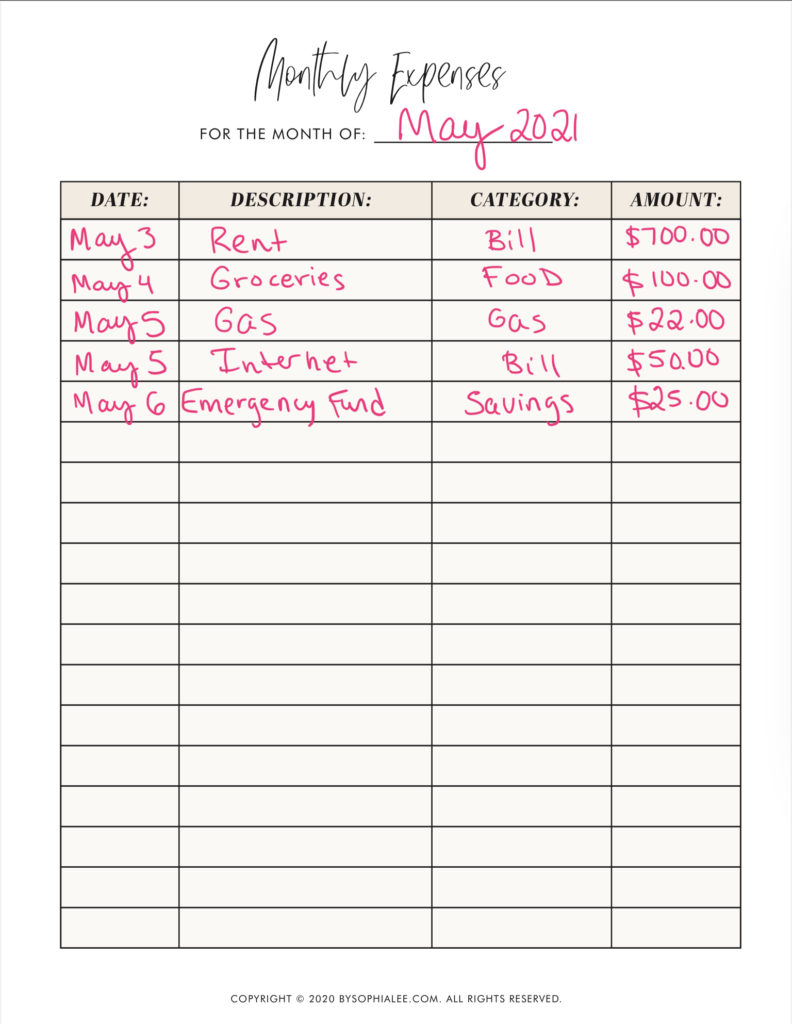

6. Money Tips Budgeting:

I have a feeling that you spend more than you want to. Therefore, you need to track your spending. This is an insanely easy tip you can implement today.

If you want to improve your finances, you need to know your spending habits and see where all your money is going. After that, you can make a plan and cut any expenses that are unnecessary.

Here’s a simple way you can start tracking your expenses for the month:

7. Do A No-Spend Challenge:

If you’ve never heard of a no-spend money challenge, I’m here to tell you that is insanely good for your finances. Because it will help you cut back on spending temporarily, so you can reach another money goal faster.

A no-spend money challenge, it’s like being on a financial diet. But, better because you make your own rules.

For example, you can decide to do a no-spend challenge with your next paycheck. If you’ve never done a no-spend money challenge, try doing it for the next two weeks. As a result, you will do your own rules and budget the amount for your bills, groceries, gas, eating out, etc. During the challenge, you won’t spend any money on unplanned expenses.

After that, you should be able to save A LOT money and hit those money goals quicker.

To recap…

In this blog post, we’ve covered a lot of ground together from savvy money tips (that are super useful), to having different checking and savings accounts, and now to doing a no-spend challenge. Today you’ve laid a solid foundation, so you can improve your finances and achieve all your money goals faster.

If you love this resource, be sure to join our email list, so you can get more money tips and be in total control of your money.

This post was all about the best money tips you should know about.

Other Helpful Resources:

How to Get Out Of Debt When You Don’t Earn A Lot.

11 Comments