8 Popular Money Habits That Will Boost Your Finances Overnight

Wanna get better with money? These money habits are for anyone who is ready to be a better adult this month.

Some Money Habits CAN keep you broke FORE-EVERRR! They can be like holes in your pockets. No matter how hard you work, you can’t seem to keep your pockets full.

So, I’m sure you’re looking for ways you can keep more of your hard earned money in your pockets. As someone who’s struggled with this, I’m giving you the top money habits that my family and I swear by.

You are going to learn all about money habits of the wealthy, money habits that keep you poor, and more.

After learning about all of these money habits, you are going to be extra motivated to improve your finances overnight. These secrets will help you become successful with your money, no matter how much you earn.

This post is all about the best money habits you should develop today.

Money habits definition

There are SO many money habits (some good and some bad) that you may be unaware that you are doing.

If you’ve never heard the phrase money habits before, it’s a just a behavior. It’s what you do with money over and over again and it becomes a habit. (It’s how you spend your money without thinking that becomes a habit.)

Negative money habits (like spending ALL the money you earn)-is just an example of bad money habit that you probably already do without thinking.

5 Money Habits that keep you poor

1. Being Lazy

Not really being proactive or taking action with your money it’s what’s keeping you poor. Just being lazy and not planning out a budget or telling your money where to go.

Not having a plan or money goals and not being intentional (aka being lazy) is a really bad money habit that will keep you broke forever!!

2. Swiping Credit Cards

Swiping credit cards without truly knowing if you have money in your checking account it’s probably what’s keeping you broke. Because you are actually spending more than what you make.

Swiping credit cards feels like the sky is the limit; it gives you a rush of instant gratification. It makes you feel powerful like you can afford anything in the world.

But the truth is that not a lot of people know about all the hidden fees and HIGH APRs behind credit cards. And that you end up paying a WHOLE lot more than the original price.

3. Not Having a Fully-Funded Emergency Fund

If you don’t have a fully-funded emergency fund, what are you gonna do when an emergency happens? Will you swipe another credit card? Or rob Peter to pay Paul?

I mean, you’ll just dig deeper in a hole. So, you’ve got to stop blowing your money. Stop spending all your paycheck! Get into the habit of building an emergency fund and NOT touching it until there is an emergency.

4. Not thinking ahead

By not planning ahead, you end up spending more, saving less, and having way more debt. When you have to make quick money decisions (like buying a car because your car was on the last leg) you usually rush to buy something you can’t afford.

In order to win with money, you have to think ahead. You sorta have to forecast your future expenses and plan for them. People with bad money habits usually tend to procrastinate, not be organized with their bills, and hope for the best.

But, this behavior is exactly what’s keeping them broke. Because instead of planning and saving for an upcoming expense, they just quickly reach out of for the credit card, swipe it, and figure it out later. Repeat this a few times and see how much debt you can rank up.

Instead, the money habits of the rich allows them to allocate their money evenly, so they’re not going from feast to famine. They tend to plan out and save for expenses using sinking funds, which is a lot of more doable that scrambling last minute to pay for a recurring expense.

{CHECK OUT: Sinking Funds That Will Make You More In Control Of Your Money}

5. Not working on your money mindset

So you’ve got to work on your money mindset in order to create good money habits and win with your finances. You’ve gotta get rid of your scarcity mindset and embrace an abundance mindset.

Most people are stuck in a scarcity mindset, one that constantly reminds you that you’ll always be broke no matter what you do. Once you step of out of that mindset, that’s when you’ll be truly free.

Dare to have a millionaire mindset. Just like them, try to learn all you can about how to better your finances. And how to be intentional with your money.

8 Money habits of the wealthy

1. Checking Your Bank Account Daily

You want to be like the rich and create a money routine, one where you check in and see what’s going on in your bank account.

You want to quickly glance at your transactions and review what bills that are about to come out and see if there’s enough funds to cover the amount.

Think about it. By checking in your bank account daily, you can see if you are sticking to your budget or not. And you’ll be able to boost your finances just by doing this money habit daily.

2. Budgeting

You need to be smart like the wealthy. They actually spend time learning all about budgeting and organizing their money. They like to give their money some boundaries, so it’s not all gone at the end of the month.

A simple budget will help you see how much money actually have for spending.

Here’s how you can create a budget: {CHECK OUT: A Step-By-Step Guide On How To Budget}

Like I said, a budget doesn’t have to be perfect, (+plus, you can tweak it as you go). A simple piece of paper and pencil can help you organize your bills and finances for the month.

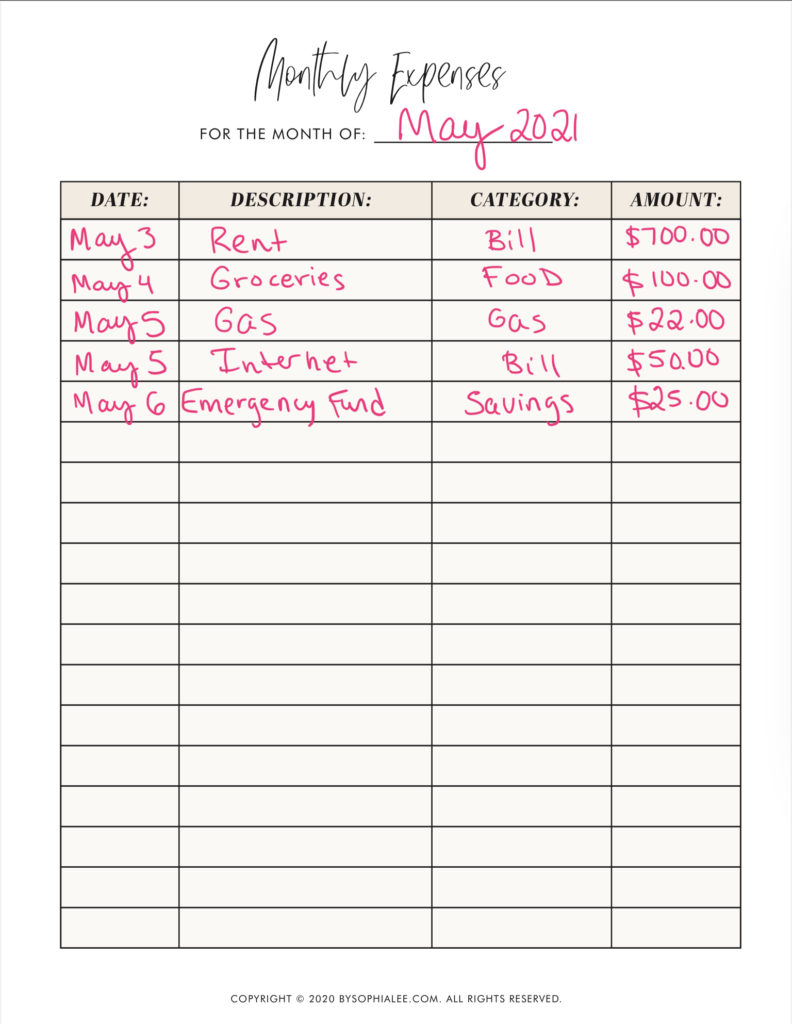

3. Tracking your expenses

I’m sure you have no idea where your money is going. You’re probably thinking is just disappearing into a black hole, lol. Turns out, that millionaires track every single penny in their bank account. Well duh! They actually have a plan for it (aka budget).

Yup, they know exactly where their money is going.

Tracking your expenses is a money habit that you can pick up today. It will help you keep accountable to your budget and make sure you’ll never over draft.

Oh, and FYI, tracking your spending doesn’t have to be complicated. Here’s an example:

3.Having Financial Goals

Creating goals will get you closer to where you want to be with financially. Maybe you want to pay down debt and get to a zero net worth and build up wealth.

Or maybe you want to save for a down payment of a house, or pay cash for a car. Either way, you need to develop the habit of creating financial goals to help you get there, just like the wealthy.

4. Always have an emergency fund

The wealthy NEVER rely on credit cards for an emergency. They actually build and maintain a nice cushion, at all times.

So, try to build up your 3-6 month emergency fund. You can start by putting as little as 10% of every paycheck into an emergency fund account.

5. Develop disciplined savings

Most successful people have to master the art of savings. In other words, they have to become disciplined savers. They train themselves to not touch that money.

If you are one of those that gets a rush of spending and can never keep any money, you are not alone. You can develop the art of disciplined savings. (Which is key in the path to financial freedom).

6. Creating multiple streams of income

Middle-class income wages have been stagnant for years. You’ll be lucky if you get a 25 cent raise every year.

Seriously, NO ONE in the hospital I work for got raises last year (2020) due to covid. I’m a nurse, and you’d think we’d get raises for risking our lives during COVID, but nope!

Generally speaking, most wealthy people look for ways to increase their income and bust out of their stagnant wages. If you think about it, there is no limit to how much you can earn.

Instead of relying on just one income and being frugal, they focus on increasing their income. They usually have 7 streams of income at all times.

Imagine getting paid 7 times a month instead of once a month! Whoah! That would propel you to financial freedom in no time!

7. They read more

According to Tony Robins “the single biggest threat to your financial well-being is your own brain. If you fail to master your own psychology, you may ultimately become the victim of a costly form of financial self-sabotage.”

Thats so true! So what money habits do millionaires develop? They read! They actively work in their money mindset. They continue learning as much as they can on self-development and financial freedom.

8. They understand money habits are 80% behavior and 20% head knowledge

80% of your financial success depends on your money habits, what you do with your money day to day. The other 20% is just knowing the knowledge the basis and fundamentals that will help you achieve financial freedom.

Like I said, you have to just show up learn and do this stuff like budgeting, tracking your spending, tracking your net worth, investing in index funds, and creating a gap between your income and expenditure. And doing it again, again, and again like 80% of the time.

No need to be fancy, just stick to the basis and doing the fundamentals well like creating these 8 money habits.

Money Habits of millionaires

Money habits quotes from millionaires:

Dave Ramsey always says “Act your wage.” What he means by this is that if you only make $30,000 a year, why would you buy a brand new car for $22,000? Get it? You shouldn’t buy a car you can’t afford.

Tony Robins says “For start, don’t live beyond your means or saddle yourself with too much debt–both reliable ways to put yourselft in a vulnerable position. As much as possible, try to keep a financial cushion.”

Chris Hogan says “the path to becoming a millionaire is paved with more ordinary tools–tools that you either already have or that you can learn.”

See? Managing your money doesn’t have to be difficult at all. And you have the power to change your money habits and get into a place where you feel comfortable with your money.

If you want more money tips, money management advice, money saving strategies, and weekly encouragement to develop good money habits, make sure you sign up to join the email list below.

Alright, that’s it for money habits!!

I can’t wait to hear from you and see what are some money habits that you’re already doing. Let me know what negative money habits you had to let go of.

Comment below, I’d love to know…

OTHER POSTS YOU MAY LIKE:

12 Amazing Money Tips and Tricks for Anyone Who is Ready To Be A Better Adult This Month.

People With Impulse Spending Make These Mistakes Way More Often

Thanks on your marvelous posting! I actually enjoyed reading it, you happen to be a great author.

I will make certain to bookmark your blog and will often come back in the

future. I want to encourage you to ultimately continue your great work, have a nice morning!

Omg!! Thank you so much for your kind and encouraging words!!! They mean a lot to me. So happy you enjoyed reading my blog post. Thank you thank you!! God bless!!!