7 Clever Budget Money Ideas That Will Help Destroy Your Debt

Want to know the most popular ‘budget money ideas’ for anyone who’s anxious about money? Here’s exactly 7 money tips you need to know about.

Budget Money the right way so you can be out of debt faster. Deciding to get out of debt is exciting because you’ll be less stress and anxious about money and sleep better too.

If you are hiding from your debt because you are feeling so overwhelmed, you’re not alone, but you need to see these 7 budget money tips. They will help you get more organized so you can stick to your budget more efficiently and make your money way more functional.

I’m going to give you insanely practical money budget ideas that I swear by. My best advice for budgeting your money is to keep it simple. The more you spend, the harder it is going to feel to stay on track of your finances.

This post is all about the best budget money ideas that anyone trying to get out of debt should know about.

Best Budget Money Ideas:

So what’s exactly the budget money meaning?

Literally, the dumb down explanation of this is that you are going to make a spending plan for your money.

In theory, it means that you’ll be listing your income and all your expenses. And making a full detail list of how to distribute your money to cover all your expenses.

Don’t cringe over the word budget because it doesn’t mean restriction. On the contrary, it means you’ll get to spend money however you want (as long as you cover your living expenses, duh).

Most importantly, knowing the budget money definition allows you to be in total control of your money.

More Budget Money Tips:

1. Budget Money so you can get out of debt.

Let’s say you are taking a road trip to Atlanta, Georgia. How exactly are you going to get there?

By following the GPS, duh!

Well, the same concept applies to your finances.

Let me ask you: how are you going to get out of debt?

Same answer: By following your budget, that’s how.

You have to create your road map (aka budget) to help you get to your debt-free destination. NO ONE is going to do that for you. Don’t wait around for Biden to forgive all your student loan debt, it ain’t gonna happen.

You must take ownership and responsibility of your debt. Once you get angry enough and serious about your debts, that will fuel you to destroy your debt.

But, first it all starts with a plan (aka budget). And, here’s exactly a step-by-step guide on how to create a budget.

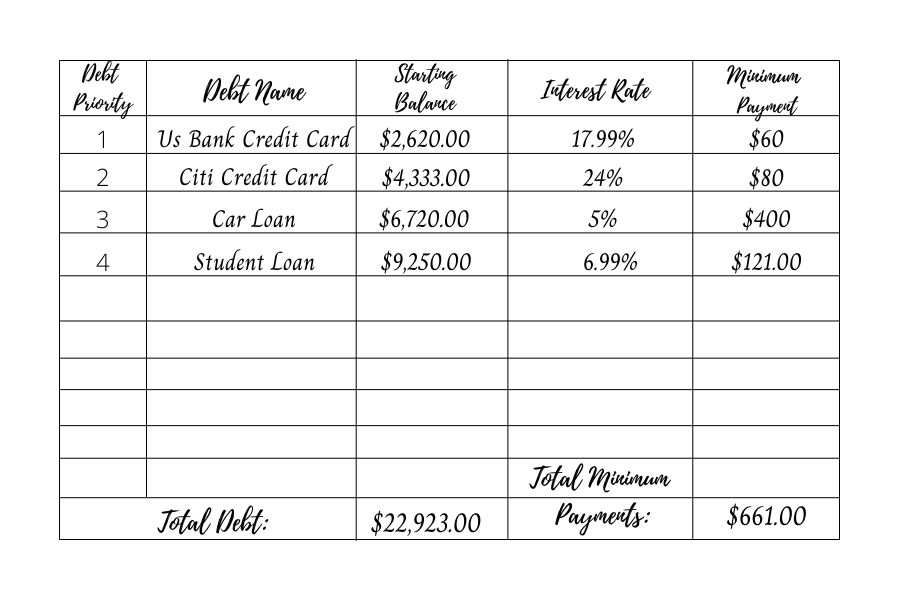

2. Organize all your debts.

Do yourself a favor and list all your debts from smallest to largest. Line them up like this.

Knowing what you owe and how much you owe will help you get a crystal clear picture on all your debts. Writing all your debts down on a piece of paper will help ease your mind from all the anxiety that come from not knowing.

Once you sit down and face all your debts, you’ll feel so much better. And, your debts become more manageable.

Then, decide which one you will pay off first. You can do the snowball method or the avalanche method. Either way, you’ll be making a huge progress destroying your debt.

3. Focus on paying one debt at a time

Breaking down your debts into small bite size pieces will make it easier for you to destroy your debt.

You’ll feel less overwhelmed by all your debts if you just focus on destroying one debt at a time. And, you’ll be able to track your progress easier.

Dave Ramsey always suggests to start working on paying off the smallest debt first regardless of the interest rate. And, once that debt is gone, you can use that minimum payment towards the next debt until you pay it off.

If you stick with his snowball method, you’ll have quick wins along your journey (which will propel you forward to keep going.)

4. Create a budget that you can actually stick to.

Now that you’ve listed all your debts and know exactly how much in debt you are, you’ll probably want to cut everything out of your budget. But, you’ll hate yourself and your budget for doing that, so don’t do it.

Create a simple budget that can allow you to budget money in a way that doesn’t feel restrictive. Because there comes a point in your budget where you can’t cut anymore.

Don’t kill yourself trying to deprive you from living life just so you can throw extra debt payments towards your debt. Remember, it won’t be sustainable and you’ll want to throw the budget out of the window and never budget again.

But, the budget is the key to destroying your debt. So, here’s exactly how to stick to a budget in 3 easy steps.

Remember, getting out of debt is a long journey, just like going on a road trip to Atlanta it will take time to get there. But here’s what you can do next…

5. Increase your income.

Have you thought about the reason why you are in debt? Maybe it’s because you don’t make a lot of money.

The same thing happened to me, I thought I made but loads of money, but boy, was I wrong!

You see, I thought I never had to budget or cut my spending because I worked full-time and I felt like I can afford whatever I wanted.

WOW! Did I have a rude awakening when I had maxed out all my credit cards and my total debt was over $72,000!

I knew something had to change.

If I ever wanted to get out of debt fast, I had to increase my income. I could no longer rely on just my income from 8am-5pm.

Did you know that most millionaires have 7 streams of income? They’re nothing like us, just relying on 1 job. Them millionaires hustle and get multiple revenues of income.

When I first heard that, I was like, I don’t want to be a millionaire. I just want to get out of the hole and pay my debt. But, then a lightbulb went off…

If I wanted to get out of debt and out of the hole that meant I had to do something different because clearly just having a 8-5 wasn’t enough to pay my debt.

So, I looked into side hustles. And you should too because it will help you get ahead and have extra payments that will help you destroy your debt.

How To Budget On A Low Income:

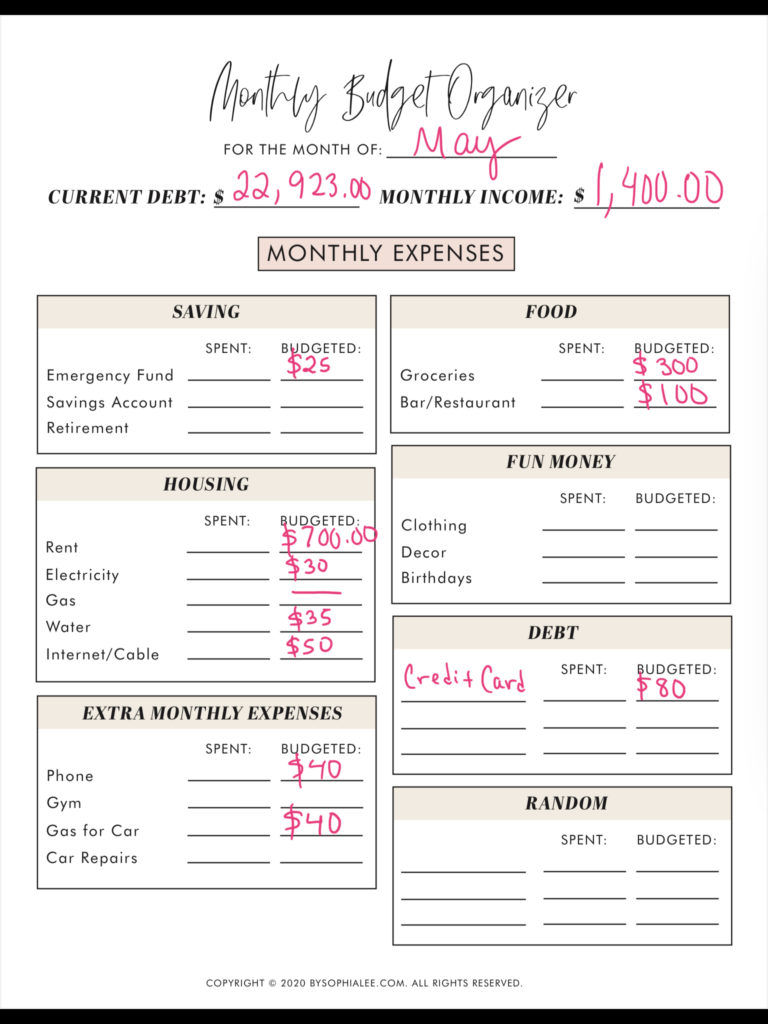

You can still budget even if you have a low income like mine. My best advice for destroying your debt is to put together really intense budgets.

Mind you, creating a super intense budget is not for everyone because it’s not sustainable.

But, if you are anything like me and want to destroy your debt fast, do an insane budget that looks like this one:

Here’s a monthly budget example:

This monthly budget printable is from bysophialee and it’s free, so you can download that same exact budget sheet and start budgeting today!

The best thing about creating your own budget is that you can customize it to fit your lifestyle.

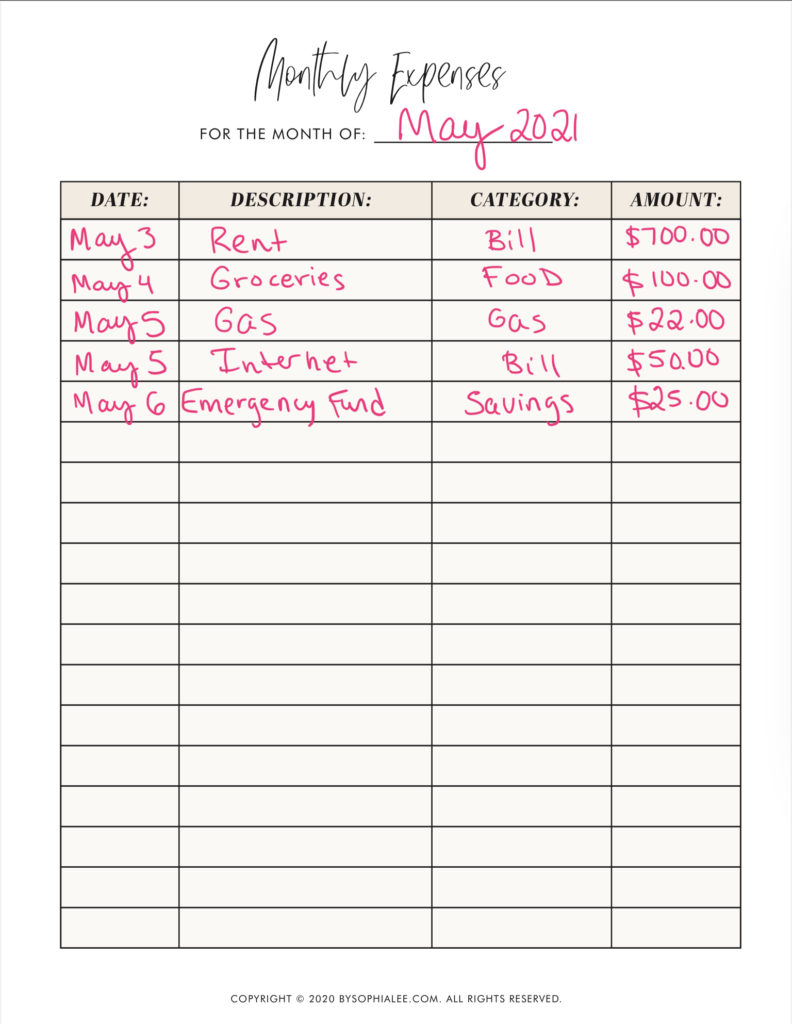

6. Track your expenses.

If you are trying to budget money, you have to track your expenses. I used to be so bad at it. I was so lazy that I didn’t want to do the work because it felt so overwhelming.

It often felt like money was just slipping thru my fingers, though.

But, once I started tracking my expenses, I realized where all my money was going. And A LOT of it was going to food, (like going out to eat and random take out runs.)

Below is an example of how to track your monthly expenses to figure out where ALL your money is going. (Again, this printable is free and is NOT mine, it’s from bysophialee).

You see, it’s not that difficult to write down your expenses everyday. That way you’ll know which areas you need to cut or budget more for.

7. Budget Money Envelopes.

Once you realize which areas you tend to overspend. Decide to do the envelope system.

Dave Ramsey teaches you to spend only in cash that way you have way more control of your money.

It’s not that difficult. After you create your budget, you’ll decide which categories you’ll want to spend money on.

Then, just pull out cash!

For example, let’s say you want to give your self $75 every time you get paid to spend on anything you want.

So, you would label that envelope “spending money” and stuff it with $75 every time you get paid.

And, carry it with you at all times in your wallet, so you can spend it for the next 2 weeks, until you get paid again.

Remember, you only do cash envelopes in the categories where overspending is a tendency.

This post was all about the best budget money tips to help you be as prepared as possible when dealing with ALL your debts.

Paying down debt is not as easy as you might think, and it definitely takes a lot longer than you want to.

It sure takes a lot of consistency and many budgets to destroy ALL your debts. But, if you don’t quit and stay the course, you’ll get there too.

What are some of your best “budget money tips” for paying off debt? Let me know because I’m still paying down debt like you.

Other Posts You May Like:

5 Personal Budgeting Tips For Anyone Who’s Ready to Be Debt Free

6 Super Trendy Debt Payoff Tips

7 Insanely Practical Money Tips For Anyone Who’s Ready To Improve Their Finances Now.

One Comment