FOR ANYONE LOOKING TO PAY OFF DEBT FASTER:

Get My Entire Easy-to-Follow Debt Free Plan Below!

Perfect if you're overwhelmed with debt and don’t know where to start—this workbook gives you the exact steps to pay off credit cards and finally build savings.

(Works Even If You’re a Beginner)

*currently on SALE!

Does this sound like you?

You’re overwhelmed by credit card debt and have no idea where to even start.

You keep paying the minimum balances, but your debt never seems to go down.

You want to save money, but there’s never anything left after bills.

You’re tired of feeling stressed about money and wish someone would just tell you exactly what to do.

What if I told you that you could pay off $24,000 in less than a year?

Step-by-step debt payoff plan (No guesswork—just follow the roadmap!)

Easy-to-use templates and trackers (So you can see progress and stay motivated!)

Beginner-friendly system (No budgeting experience or math skills needed!)

This was me drowning in over $78,000 worth of debt.

Now, after implementing this system, I'm generating consistent passive income, enjoying financial freedom, and helping others achieve the same.

HERE IS THE TRUTH...

With the Get Rid of Debt Workbook, You Can Skip the Learning Curve and Immediately Start Saving Thousands of Dollars...

And Have The Freedom You've Always Dreamed Of

Easy to read and follow. Looking forward to implementing the information. Thank you for making this so straightforward.

Susie Hawkey

Started doing the debt payment plan, paid off 4 debts since October! Using your guide is so awesome. Thanks

Damaris Lopez

On my debt-free journey since October, I am now down to less than half of my debts. Thank you so much!

Mayra Rivera

With This Debt Payoff Plan, You Can Start immediately saving money on interest...

🩷 Improve your credit score.

🩷 Save thousands of dollars on interest.

🩷 Reduce stress and anxiety.

🩷 Free up money for savings and goals.

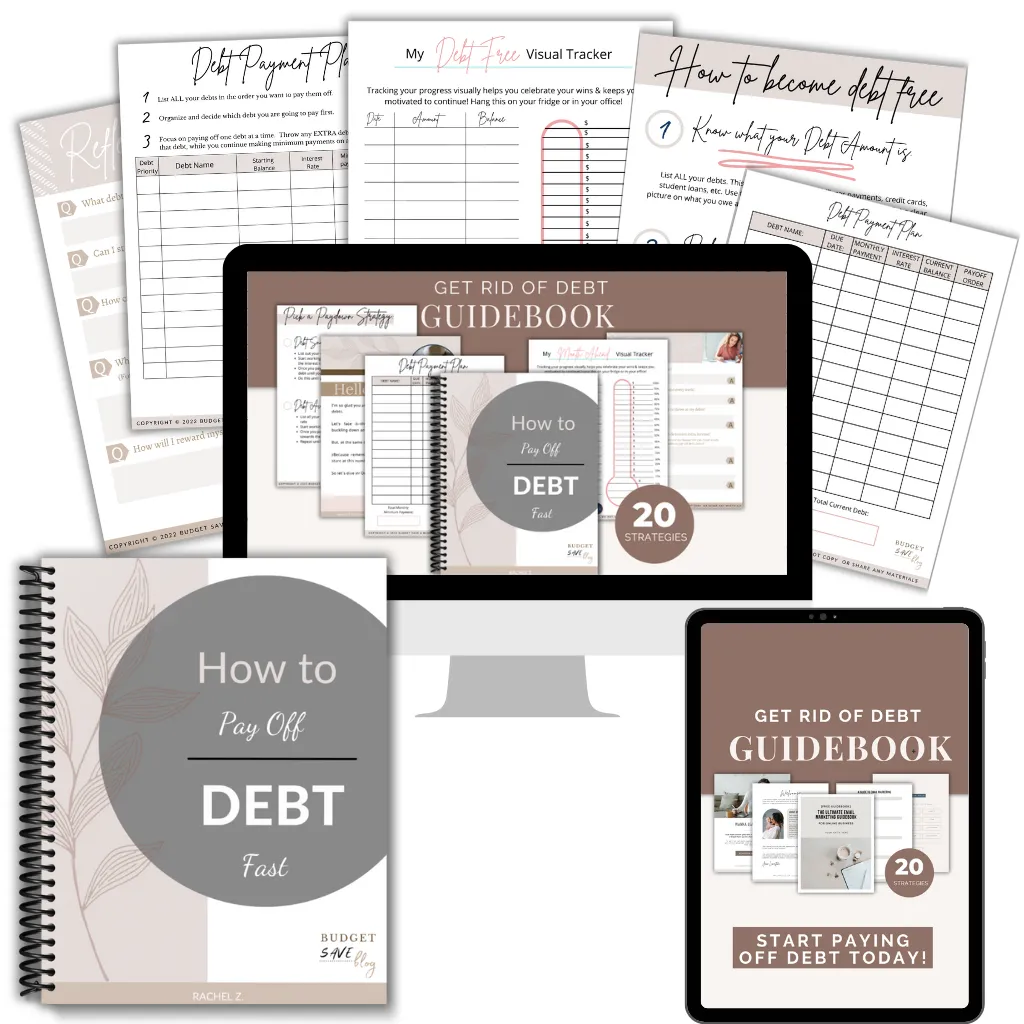

Here's Everything Included with the Get Rid of Debt System.

Crafting your Debt-Free Roadmap: you're going to organize your debts, prioritize which to pay off first, and finally feel in control of your finances (no more guessing what to do next!).

Building a system to pay off debt faster: a step-by-step process how to setup your whole system to start making progress on your debts quickly.

Customizable Debt Payoff Trackers: Visually track your progress and stay motivated with printable and digital trackers—because seeing your wins builds momentum and confidence.

Smart Savings Starter Kit: Build your emergency fund while paying off debt. This section helps you stop relying on credit cards for emergencies and finally get ahead.

Goal Setting & Motivation Pages: Clarify your “why,” set intentional money goals, and stay encouraged with mindset prompts and progress check-ins. Debt freedom starts with a clear vision.

Quick-Win Strategies to Free Up Cash: Learn practical, beginner-friendly ways to cut costs, increase income, and find extra money to put toward your debt starting this week.

Bonus: Credit Score Boosting Tips: Simple actions you can take now to improve your credit score as you pay off debt—so you can unlock better financial opportunities sooner.

Digital + Printable Format: Use it digitally or print it out—your choice. Start immediately, from anywhere, and go at your own pace.

One-Time Purchase, Lifetime Use: Buy once and use it as many times as you need. Reuse it every time you tackle a new financial goal or want to stay on track.

Regular Price: $37.99*

Start TODAY For Just $7.99!

Frequently Asked Questions

Will this work if I have multiple types of debt (like credit cards, loans, etc.)?

Yes! Whether you're juggling credit cards, student loans, or personal loans, this workbook helps you organize it all in one place and build a plan that fits your unique situation.

How soon will I see results?

Many people start feeling relief within the first week of using the workbook—just from getting organized and creating a clear plan. The more consistent you are, the faster you’ll see your debt go down and savings go up.

What exactly do I get when I purchase?

You’ll receive a beautifully designed, easy-to-follow digital workbook packed with debt payoff worksheets, savings trackers, goal-setting pages, and bonus tips to help you stay motivated and focused.

Is this a physical workbook or digital?

This is a digital workbook you can download instantly and print at home or use on a tablet. That means you can start taking action immediately—no waiting!

What if I don’t have a lot of money to put toward debt right now?

That’s exactly why this workbook exists—to help you find extra money, cut expenses strategically, and prioritize what you can with what you have. Every small step counts, and this guide makes it doable.

Your Debt Free Lifestyle Is Just 3 Simple Steps Away

1

Grab Get Rid of Debt Workbook

Sign up today to get instant to all the materials, video lessons and tools you need

2

Follow The Step-By-Step Framework

Work through the lessons, materials, and use the resources inside the program to fast-track your results.

3

Automate Your Finances

Set up your system that's working around the clock so you can start saving money and getting ahead!