How to Start Paying Off Debt In 5 Easy Steps

Want to learn how to start paying off debt but not sure where to begin? This comprehensive guide will walk you through how you can start making extra debt payments in 5 easy steps!

If you are reading this post, chances are you want to get out of debt and increase your savings.

You’ve probably ignored your debts for TOO LONG, hoping they’ll go away. And now you’re feeling they are weighing you down.

Maybe you want to buy a house, but you can’t because most of your paycheck goes to paying off debt and you can’t really save any money.

Sound familiar?

The good news is that you’ve come to the right place!

This post will walk you through how to organize your debts and how to start paying off debt in 5 easy steps.

My goal is to empower you to take action! I want you to feel financially free and celebrate as your debt goes down. I don’t ever want you to struggle with money and feel powerless, that’s why I want you to commit to learn how to start paying off debt. So you can sleep better at night and not worry or scramble at the end of the month.

Are you ready to get started?

Let’s do this!

How to start paying off debt?

In this post you’ll learn:

- Step One: Organize Your Debts

- Step Two: Choose Between Debt Snowball or Avalanche Method

- Step Three: Create a Budget

- Step Four: Throw Any Extra Money Towards Your Debt

- Step Five: Increase Your Income

Step One: Organize Your Debts

Don’t ever let debt hold you back from doing whatever it is you want to do with your money.

The first step to being financially free is to list ALL your debts. (Every. Single. One.)

That way, you feel more in control of your debt and not let the debt control you.

Don’t you ever feel better after you write stuff down? Sometimes we hype up stuff in our minds, and they seem so big and scary but once you sit down and write them out, you’re like oh that’s it?

For example, I got so worked up and anxious thinking I went over budget when I went to the grocery store. I was like OMG I blew up my budget again! But, when I sat down and ran the numbers, I was still on track and within budget. Phew! What a relief!

It wasn’t until I sat down and punched the numbers together that I realized I was still within my budget.

The same thing can happen to you.

You might be thinking you owe so much money, or you may think that it’s not possible to ever get ahead. But, list all your debts. (It may not be that bad).

When I summed up all my debts mine totaled over $78,000 and I’m not gonna lie, I almost passed out. And not to mention that I lost sleep for several days, until I came up with a game plan.

Once I learned how to start paying off debt, I gained momentum and it was game on!

You too, can master “how to start paying off your debt.” That way, you’ll start to feel in control of your money, gain traction, feel more confident, and watch your debt melt away.

If you are wanting peace of mind, you’ve got to list ALL your debts and come up with a game plan.

This is the crucial first step on your debt free journey!

Step Two: Decide How to Start Paying off Your Debt

This is the part where you come up with a game plan and decide how to start paying off your debt.

You can choose between paying your debt using the debt snowball method or the avalanche method. Or a mix between the two.

The snowball method, suggests you list all your debts from smallest to largest. Then, you start attacking the smallest debt. Just throw any extra debt payments towards the smallest debt regardless of the interest rate.

The avalanche method suggest you line up your debts from highest interest rate to lowest interest rate. Then, you start paying off your debt regardless of how big your debt is. This method is used so you can save money on interest.

Or you can do a mix of both methods. You can start paying off debt with the highest interest first. And once that’s paid off, you can start paying the smallest debt balance next.

Like I said, once you learn how to start paying off your debt, you are in total control of your money. You decide what gives you more peace of mind. Decide which debt you want out of your life first and start paying it off.

{RELATED POST: How to Use The Debt Snowball and Debt Avalanche Method To Destroy Your Debt }

Step Three: Create a budget

If you want to be in control of your money, you have to tell it where to go.

Creating a budget is the way to do it. Don’t freak out if you’ve never budgeted before.

Remember, a budget is just a spending plan. Is where you plan ahead and decide how you want to spend your money.

Creating a budget will help you see how much money you have available to pay towards your debt.

Think about it. If you really want to see results fast, you have to stick to a plan (aka budget). Budgeting is a lot like dieting, you have follow a plan to get results you want.

Learning and crafting a budget that fits your needs is the second crucial step on how to start paying off debt.

{Related Post: A Step-by-Step Guide On How To Create A Budget}

Step Four: Track Your Progress

Learning how to start paying off debt can feel overwhelming and lonely, especially when your friends don’t get it and keep inviting you to spend money on stuff you can’t afford.

So, you need motivation…

Because paying off debt is not a sprint, it’s a pretty long journey with lots of ups and downs.

You may feel like all you have left after paying all your bills is just $10 to make as an extra payment on your debt. But it’s all those small extra payments that will get you out of debt.

You know, I once had a tree in front of my house that had carpenter ants crawling all over it and getting in the house. It wasn’t until we took the tree down that the problem with the ant got resolved.

To be honest, we did not want to uproot the tree because it was pretty and it would be a lot of work. But we still had a bunch of those ants all over the house, the pest control guy was pretty much over the house spraying every week, trying to control the ants. But nothing worked.

Well, the day came that we had enough of those carpenter ants. So we took it upon ourselves to uproot the tree.

This was a huge undertaking, I had to first dig around for days to get to the roots. Every time I shoveled it didn’t seem like I was making a dent at all. But I kept at it, I was determined I would get this tree out of the house.

And I DID!!!

It took way longer than I wanted to, but I finally got under it and was able to uproot the tree.

Similarly, the way you start paying off debt may seem like you’re barely making a dent in that huge pile of debt. But every single extra payment you make, even if it’s just $10, it’s like you’re digging you’re way out of debt.

It’s all those small extra payments that don’t seem like they’re doing much, WILL get you out of debt. It’s just like that tree in front of my house…

Every single time I grabbed the axe and shovel, I was making some sort of progress even if the tree was not even moving.

But eventually, all those small actions, let me to the roots and I was able to loosen up the tree and finally uproot it.

You get the point. Don’t underestimate the power of all those small extra debt payments you are making to pay off your debt. They will eventually compound and you’ll be out free!!

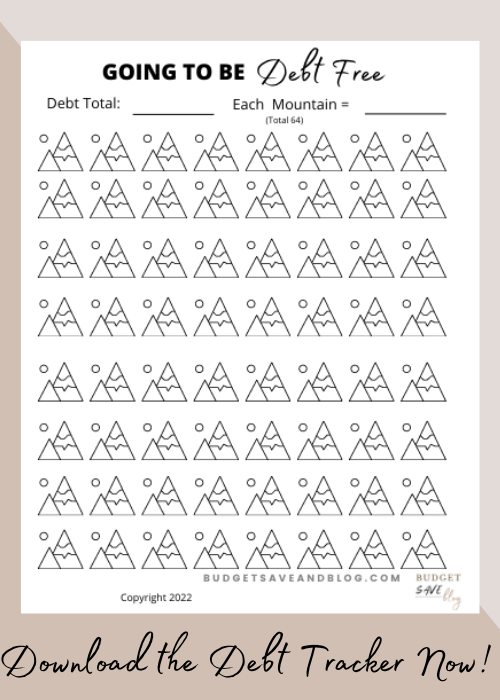

In order to successfully learn how to start paying off debt, you have to track your progress. You have to visually see for your self the debt going is going down.

And what a better way to do it than to use the debt tracker. You can color in your progress every time you make an extra debt payment.

Step Five: Increase Your Income

If you already feel like you don’t have any money left after paying all your bills, then increase your income.

Start a side hustle. Bringing extra income that can go straight to debt will help you get out debt faster.

Here are some ways you can increase your income:

- Driver for Uber of Lyft

- Deliver Food

- Start a blog (and document your debt free journey)

- Tutor

- Teach English Online

- Babysit

- Volunteer for overtime at your job

- Pick up second job part time on the weekends

- Dog walking or pet sitting

These are a few ideas where you can bring in more income. You know the days of relying on just one income are gone.

Seriously, with inflation, gas prices and food prices are rising….

You can’t rely on just one stream of income.

Did you know most millionaires have 7 streams of income?

You too, can create more than one income for you and your family. And that will accelerate your debt freedom.

This was the biggest mistake I made at the beginning of my debt free journey, I focused so much on paying off debt, that I wasn’t creating opportunities to increase my income and accelerate my debt free journey.

In conclusion…

This blog was all about how to start paying off debt. It showed you how you can organize your debts and choose how you want to start paying them off.

You learned how essential crafting a budget is and also tracking your progress using a debt tracker.

And finally you learned how risky it is to just rely on one stream of income.

Greetings! Very helpful advice within this article! It is the little changes that will make the most significant changes. Thanks a lot for sharing!