How to Use The Debt Snowball and Debt Avalanche Method to Destroy Your Debt

Ultimate Guide to pay off debt using the Debt Snowball vs. Debt Avalanche Method -Which one is better?

Debt snowball and Debt Avalanche are the 2 of the most popular debt payoff methods you should try today.

Dealing with debt can be super draining and overwhelming. Sometimes it’s easier to just ignore it all and pretend it doesn’t exit and wish it would go away.

However, you may not recognize how much debt is actually weighing you down. It’s probably stealing your sleep and your whole paycheck too.

Did you know that when I sat down and added all of my debts, my minimum payments added to a HUGE amount that was WAY more than my mortgage!!! (Yup, my mortgage payments were A LOT less than all my monthly payments to credit cards, student loans, car loans, etc).

When you add up all of your debts you might find yourself in A LOT more debt than you originally thought. So what are you gonna do about it?

I know I agonized over it, cried and lost a lot of sleep. And finally decided to deal with it. So, if you are in a position to start tackling debt, you can use the most popular strategies like the debt snowball and the debt avalanche method.

This post is all about debt snowball and debt avalanche method.

Debt Avalanche vs Debt Snowball

Debt Snowball Meaning

The debt snowball definition is simple. It just means you list all your debts from smallest to largest in a sheet of paper. Basically, you organize all your debts, you prioritize them by listing them from lowest to highest.

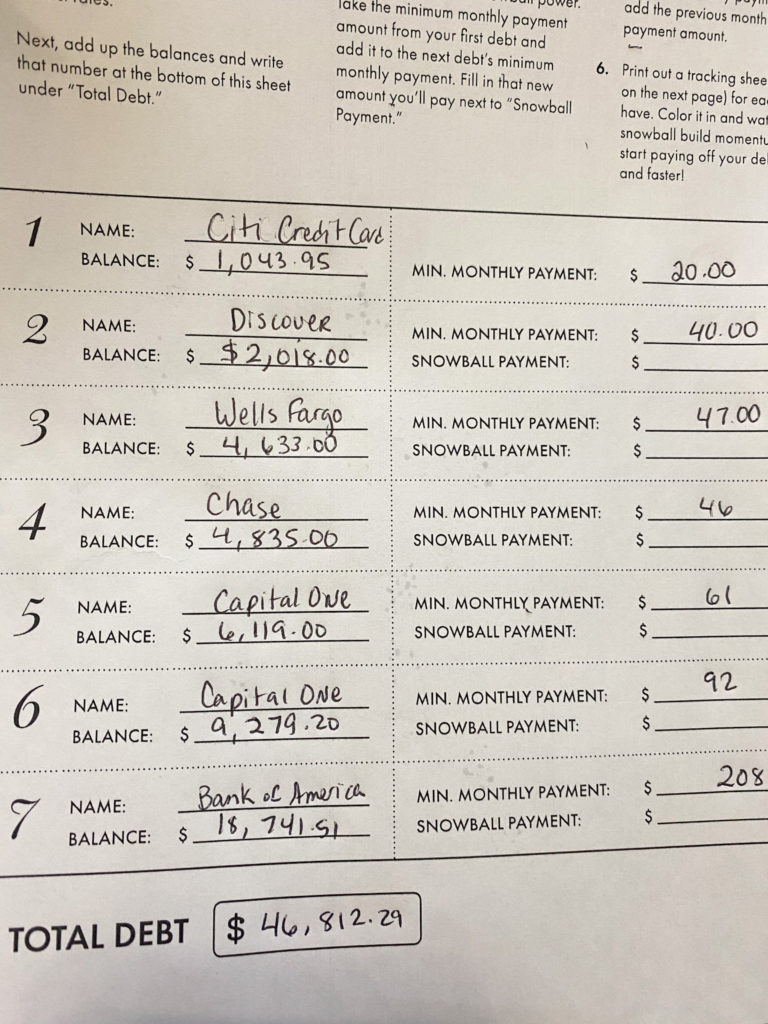

Here’s a really bad quality picture of how this looks like. (I used this free debt snowball pdf from rachelcruze website.)

You see? It’s not that difficult! They are all listed from smallest to largest.

What is the debt snowball plan?

Step 1: You should list all of your debts regardless of the interest rate.

Step 2: Start paying all your minimum payments in ALL your debts. Then, throw any extra money on the smallest debt.

Step 3: Once you pay off that small debt, use the minimum payment (a.k.a. snowball) towards the next debt.

For example, in the picture above the minimum payment is $20 and let’s say you pay if off. That means, you have freed up $20 that you can now apply towards the next debt. So, the second debt minimum payment is $40 but now with the snowball applied, it jumps up to $60.

Get it? Good!

When you pay off the smallest debt, you can add that minimum payment amount to your next smallest debt payment. (That’s the debt snowball method.) (You roll the freed up money towards the next debt).

Step 4: REPEAT! Your snowball should grow and pick up more speed and knock all your other debts until you’re debt free.

Does the debt snowball method really work?

Yes it does! I’m living proof of it. I’m not debt free yet, but I’ve been able to knock out a lot of small debts and my snowball has grown exponentially. (Which I can now apply to other debts with bigger amounts).

Something that I really enjoyed about using the snowball method was the motivational boost I got from the quick wins. I loved seeing my quick progress and paying debt after debt, it was pretty addicting.

And like Dave Ramsey always says motivation is the key to getting out of debt. (That’s why he swears by the debt snowball method). He believes if you do the avalanche method that you’ll loose steam and wanna give up.

What are the benefits of snowballing debt?

Like I said, you’ll get quicker wins that will make you continue paying off your bigger debts. Also, using that same money (you had to pay for your minimum payments) and applying it to your next debt makes your debt payoff feel effortless.

So, even if you don’t have a lot of EXTRA money to throw towards your smallest debt, you can at least apply that minimum payment (once you finish paying it off) towards the next debt.

Seeing your debt disappear should give you a HUGE sense of accomplishment. (That you are ready to tackle anything that life throws at you.)

How do you snowball out of debt?

By creating a snowball, (which comes after you pay off your first smallest debt).

To snowball out of debt you first have to list all of your debts from smallest to largest.

Then, pay all your minimum payments.

After that, you pay EXTRA money on the smallest debt.

After you pay if off…here comes the debt snowball!!! You’ll roll that minimum payment to your next smallest debt. And repeat it until you’re DEBT FREE!!!

Debt Avalanche

It’s another popular debt payoff method. It’s where you decide to pay the debt with the highest interest rate first regardless of the debt amount.

Step 1: List your All of your debts from highest interest rates to lowest interest rates.

Step 2: Continue making all your minimum debt payments to all your debts except the one with the highest interest rate.

Step 3: Throw any EXTRA money towards the debt with the highest interest rate.

Step 4: Once you pay off the debt with the highest interest rate, apply that payment towards your next highest interest rate debt.

Step 5: Repeat the process until you’re debt free!!

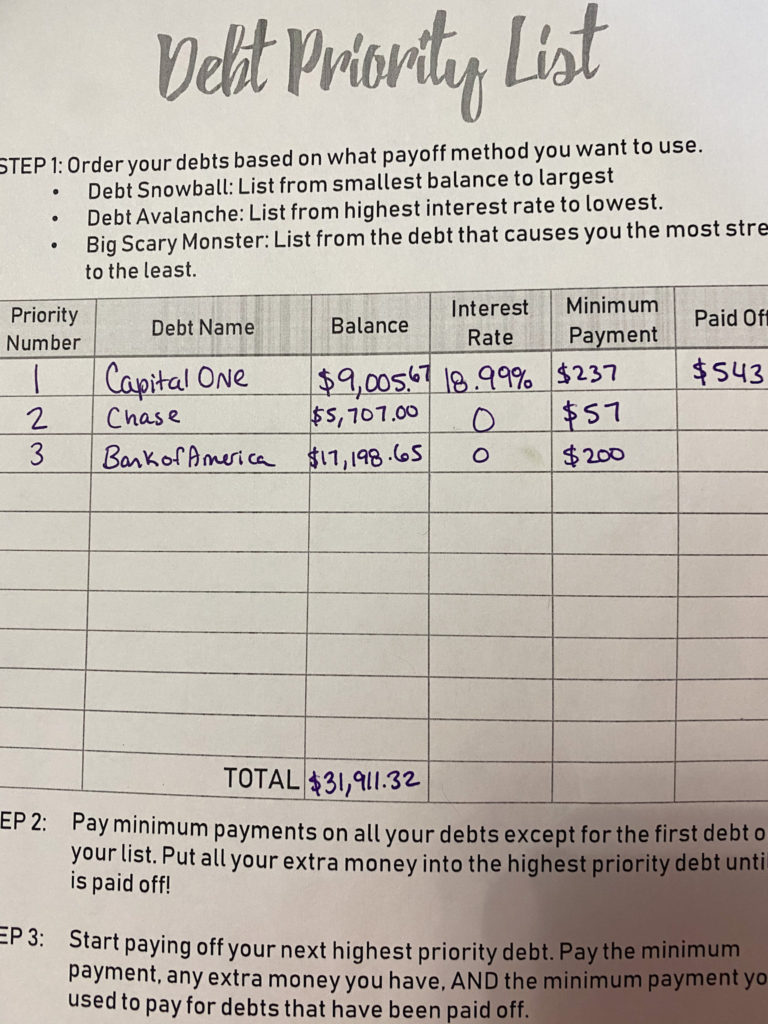

Here’s another bad picture of how this looks like. (PS– This sheet is from SMARTMONEYMAMAS –you can click here to get your free debt payoff tracker too).

So, I used both popular payoff methods. Since credit card number 2 and 3 were at zero interest for a few months, I decided to do the debt avalanche method and attack the highest interest rate credit card at the time.

It certainly took a lot longer to pay off versus a smaller debt. But, I was so furious at the interest rate that I got focused and started throwing any extra money to that debt and paid if off.

Phew! Now I could breath and tackle the other ones using the snowball method.

Which is better debt snowball or debt avalanche?

They both have negatives and positives. So, you have to decide what works better for you. You can definitely use both methods and mix things up.

If you need to stay motivated and see instant changes on your debt, then the snowball method can be for you. But, if you are angry (like me!) and hate seeing your money go towards interest charges every month, then the avalanche method is for you.

Oh, and FYI, personal finance is personal, so don’t let ANYONE pressure you into doing one method over the other. Remember to do what feels right for you and makes sense with your budget. And it’s totally ok if it takes you longer to pay debt off just as long as you stay the course.

This post was all about debt snowball and debt avalanche method that might work for you.

OTHER POSTS YOU MAY LIKE:

People With Debt Make These Mistakes Way More Often

5 Personal Budgeting Tips For Anyone Who’s Ready To Be Debt Free

6 Amazing Debt Payoff Tips That Can Be Life Changing

7 Clever Budget Money Ideas That Will Help Destroy Your Debt

4 Comments