6 Smart Money Saving Strategies That Are Proven To Work

Want to know the best money saving strategies that will help you keep more of your money? These are insanely practical money saving strategies you need to know about right now.

Money saving strategies for anyone trying to save money after the pandemic.

Getting to actually save money is extremely exciting, especially since it’s like the hardest thing to do. Did you know that 1 in 3 Americans can’t cover a $2,000 emergency with cash, according to recent survey?

The same survey states that the number of people living paycheck to paycheck is on the rise. Are you one of them?

If you are, you’ve come to the right place. Because as someone (just like you) who struggles to save money, I’m giving you the top money saving strategies that my family and I swear by.

You are going to learn all about practical money saving strategies that will help you achieve your financial goals.

After learning realistic ways to save money, you’ll be a pro at saving WAY more money and paying cash for stuff you want, (instead of relying on debt).

This post is all about the best money saving strategies.

Best Money Saving Strategies:

1. Create a Budget

I know you want to cringe when you hear the word budget, but all a budget is just a conscious spending plan for your money. If you hate the word budget, then call it a spending plan, in which you have ALL the power to control your money, which is actually pretty cool.

Having a budget will help you organize your money and your bills. You’ll know exactly how much you get paid and what you’ll be doing with that money.

Creating a budget will allow you to be completely aware of the money coming in and the money going out.

{CHECK OUT: A Step-By-Step Guide On How To Create a Budget}

{CHECK OUT: How To Budget Money}

What is the 50 20 30 budget rule?

Is a type of budgeting where you split your paycheck into these 3 main categories:

Use these guidelines for your spending and tweak as necessary.

Needs: include rent, utilities, debt payments, food, transportation, car insurance, gas, etc. These should be covered with only 50% of your paycheck.

Savings: can include vacation, gifts, house downpayment, new-to-you car, building an emergency fund, etc. You can save for these things little by little, using the sinking funds method. These saving goals should only be 10% of your paycheck.

{CHECK OUT: Sinking Funds That Will Make You More In Control of Your Money}

Wants: can include guilt-free spending like dining out, drinking, movies, clothes, shoes, shopping at Target, etc. This is the fun stuff you do with your money, but keep it to only 20% of your paycheck.

2. Create Financial Goals

Once you have your budget set up, create short-term financial goals and long-term financial goals. Taylor your savings to your specific needs and prioritize them.

For example, if you need to go on vacation, set up a short-term goal. Let’s say it will cost you $1,200 for a vacation next year. So, you would have to save $100 each month for 12 months. Or $50 per paycheck and voila you can pay cash and not rely on your credit card. It just takes a little bit of planning and discipline to put the money aside and not spend it.

Setting up specific financial goals will help you focus on aiming at a target, so you can hit it. The same thing goes with a specific goal, in your mind it becomes more realistic and attainable. And it won’t be as hard to save for it.

3. Automate savings

Once you have clear financial goals and have decided the amount you need to save from each paycheck, just set it and forget it.

Automate your savings: transfer the money straight to your savings account, as soon as you get paid so you won’t spend it!

This is what is actually called: pay yourself first. Instead of paying bills, groceries, debt payments first, you’ll SAVE first! Because if you leave savings until after you pay everyone else, there might not be anything left to save.

4. Save in Cash Envelopes

Good money saving strategies include saving in cash envelopes. Oh, and FYI, it’s a proven method that works!

Decide your money categories that you want to save like vacation, anniversary, car maintenance, taxes, clothes, eating out, etc.

Create cash envelopes of each of these categories, go to your ATM and get the cash, then stuff all your envelopes.

Cash envelopes are super helpful especially when you have a hard time saving. Because you’ll pull the money out of your bank account immediately when you get paid.

“Out of sight, out of mind.” You’ll be hiding and stashing money away as you save. Which will make you feel more powerful and more in control of your spending, when you use these cash saving ideas.

5. Set No Spend Days

Don’t swipe your debt or credit card during NO-Spend Days. Let them rest! Don’t spend cash either.

A no-spend day will help you stop buying stuff you don’t need. It will help you sleep on a purchase and decide the next day if you still want it.

My husband and I set the month of February as a no-spend month. That meant, we would not buy anything that was not written on a budget like the essentials: food, mortgage payments, debt payments, automatic savings, bills, etc. But we would challenge each other to NOT spend ANY money for 1 full month. We chose February since it’s the shortest month of the year lol.

But here’s how you can do it: Start with just two no-spend day in a week, and see how you do. You may have to be dramatic and leave your debit and credit card and cash at home so you won’t be tempted into buying something.

Make your own rules! Here’s an awesome No Spend Monthly Tracker from the BudgetMom. Download yours free from her website.

6.Let go of your limiting beliefs

If you believe you can’t do it, guess what? you won’t do it.

For example, you’ll never pay off your debt if you don’t believe you can.

Because you are a product of your thoughts.

So use it to your advantage! Try this instead: Believe you can save, and you’ll start saving fast!

What is the best strategy for saving money, fast?

These are some realistic ways to save money:

- creating saving challenges

- automating your finances

- looking at your subscriptions and cutting anything out

- making your own meals

- making your own coffee/tea

- doing a no-spend month

- trying the high five banking method

- rewarding yourself for attempting to save

- believing in yourself

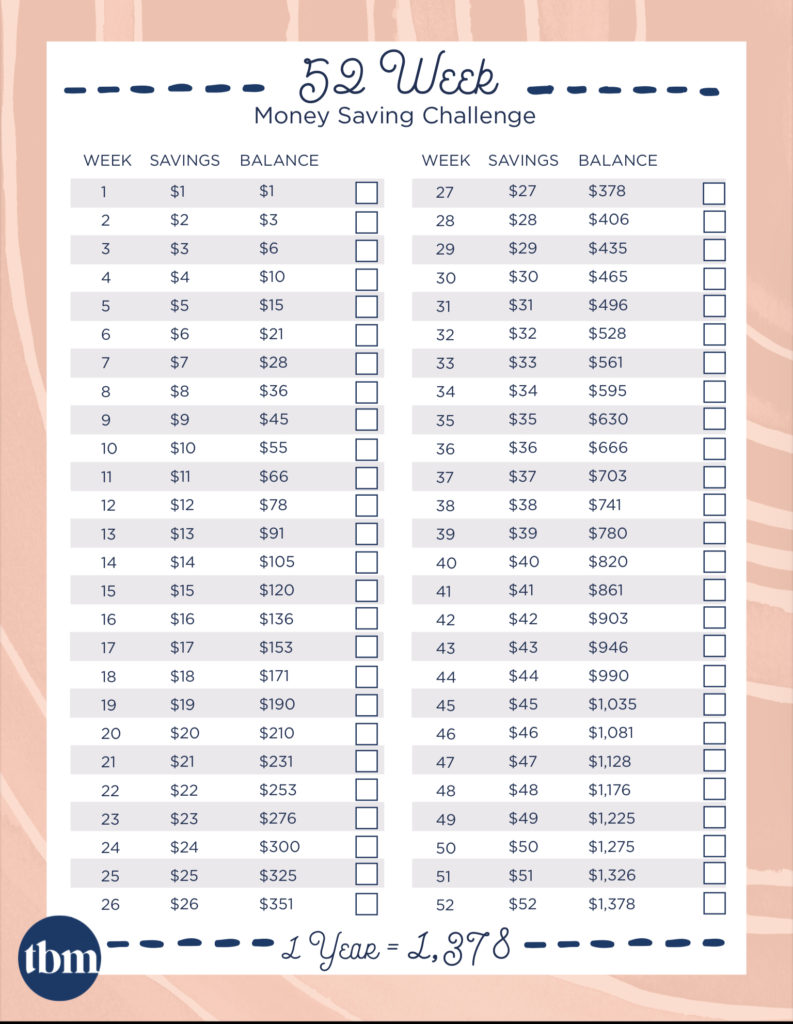

Don’t be afraid of trying out a Saving Money Challenge

Take a look at this one from The Budget Mom website. You’ll be able to save $1,378 in 1 year, without much effort. It actually starts with just putting away $1 the first week. And you’ll be doing it for 52 weeks, so it’s not as hard as difficult as you think.

If you want to join our community and get more saving money challenge ideas be sure to join the list, so you can jump into the saving bandwagon.

Make sure you get your free savings challenge worksheet free in the Free Resource Library from the Budget Mom.

Best way to save money for future

Hands down it’s creating Sinking funds! If you have no idea what a sinking fund is, check out this post: Sinking Funds That Will Make You More In Control Of Your Money.

You have to decide what future expenses are coming up and start saving for them ahead of time. Maybe you can set aside $20 or $30 from every paycheck to fund a future expenses.

Basically, you would plan out that future expense and break it down into small manageable saving amounts.

For example, I save a lot more money if I pay for my car insurance once a year. The total one-time cost for a 2 car insurance is $729.26 yearly.

So what I do is save for this future large expense by setting aside $30 every time I get paid. So, that’s like $60 a month for me. And believe it or not, I’ll have that future expense all saved up for next year when I get my bill.

You get it? You just have to break down a large future expense into small manageable savings portions and be disciplined enough to not use the money at all until the future expense comes up.

These money saving strategies are genius! Because that way you won’t be scrambling last minute looking for money when the bill comes up. And you won’t saddle yourself with more debt. You just simply use your sinking fund and pay for it. And that’s it!

Alright, that’s it for good money saving strategies that are proven to work!

If you’d like to learn more about debt payoff strategies, how to save money each month, and get money management advice, be sure to sign up to the email list, so you can catch all the freebies!

OTHER POSTS YOU MAY LIKE:

8 Popular Money Habits That Will Boost Your Finances Overnight

7 Insanely Practical Money Tips For Anyone Who is Ready To Improve Their Finances Now

People With Impulse Spending Make These Mistakes Way More Often

12 Amazing Money Tips And Tricks For Anyone Who Is Ready To Be A Better Adult This Month

3 Comments